- Join Now

- Login

- Member Zone

- Your Career

- Freelancing

- International Grooms Association

- BGA Training

- Healthy Yard Healthy Horses

- Transporting horses

- Brexit

- Safe workplace

- Student Zone

- Member Discounts

- BG Magazine

- Member services

- Training & Careers

- BGA CV Creator

- Horse groom training

- Where to Train

- BGA E Learning

- Career choices

- Change to Racing

- First Aid training for grooms

- Parents

- Grooms Jobs

- Grooms Life

- About

- News

- Contact

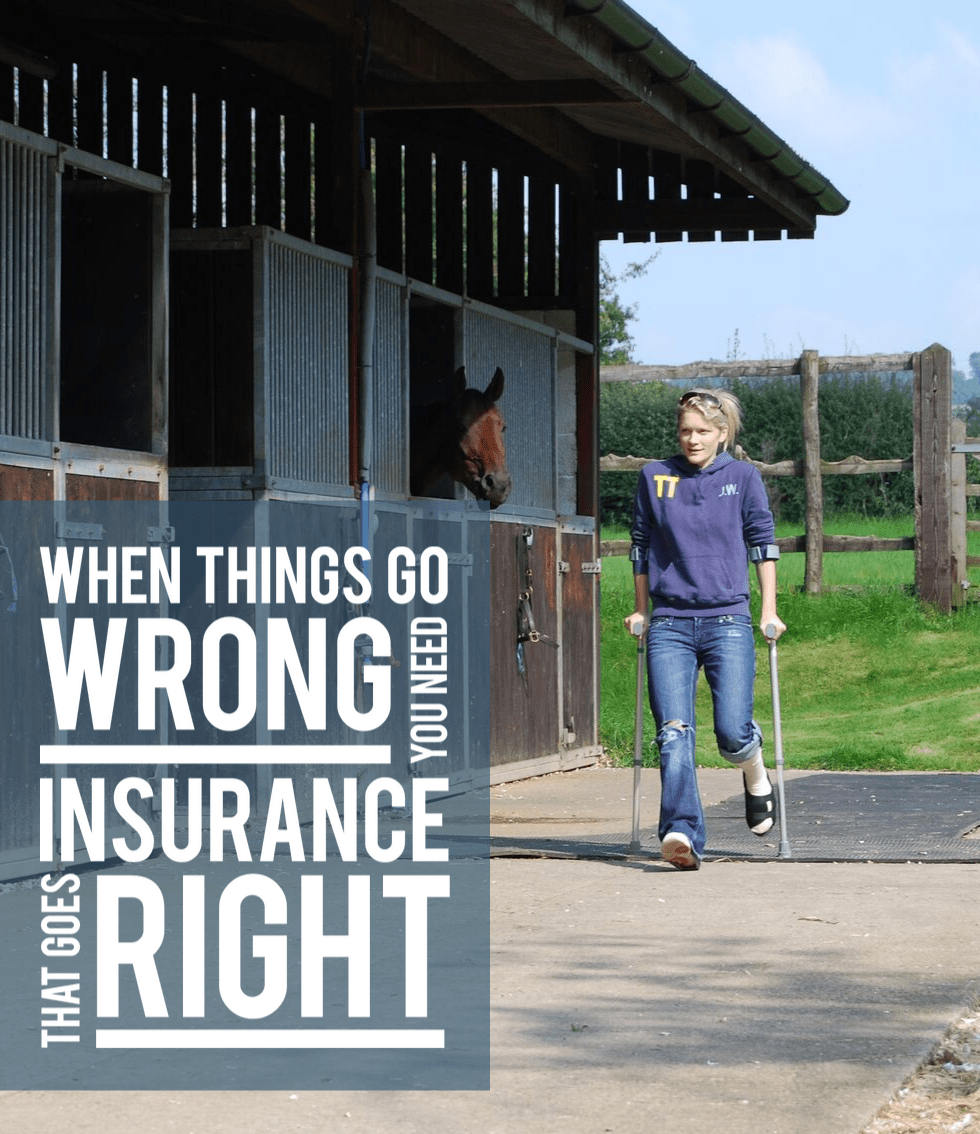

What is Grooms' Insurance?

Grooms' insurance is an insurance policy specifically designed to meet the needs of employed and freelance grooms.

But what insurance policy should you have and how to make sense of all the different options?

There are many providers on the market offering insurance for grooms that offer a range of policies depending on your own personal circumstances. For example, if you are working with horses then the BHS's Gold membership will not cover you as it is a recreational policy only.

However, one the most concerning things that we see time and time again, is grooms, under the impression that they are covered for something when they are not.

To understand this better let’s take a look at the different types of policies available:

Personal Accident Insurance for Grooms

Personal accident insurance will protect you against personal injuries that occur at work.

Depending on your policy and level of cover personal accident insurance can cover loss of earnings as a result of your accident - known as Temporary Total Disablement (TTD) - see what it covers

The BGA's Bronze, Silver and Platinum memberships include personal accident insurance of varying levels and is suitable for both freelance and employed grooms.

I am freelance

Personal accident insurance is really important for freelance grooms.

Why? Because self-employed grooms do not receive Statutory Sick Pay (SSP). Therefore, if you’re freelance and you get injured at work and need to take time off to recover, then you won’t receive any salary/income/money if you don’t have the right policy in place.

At the British Grooms Association we believe that many freelance grooms aren’t adequately covered because many have only ever taken out a liability insurance policy.

If an accident were to happen, you had an injury and you only had liability insurance - then your income would not be protected. Check that your 'groom's insurance' that you have been sold includes personal accident cover.

I am employed

If you are employed, you still should consider having a personal accident insurance cover.

Working with horses is hazardous and accidents really do happen. Trust us, we hear about them all the time!

If you are employed, and you meet the criteria, you will get Statutory Sick Pay (SSP) - however this is only £95.85 per week. So it makes sense to have your own personal accident cover to protect your income.

Take our advice and get covered for personal accidents with BGA Bronze, Silver or Platinum Membership

If you’re not sure what kind of policy you’ll need then use our quick quiz and we’ll match you to the right membership:

LIABILITY INSURANCE FOR GROOMS

Liability insurance protects against things going wrong that are out of your control but are caused as a result of something you have done.

For example, if the horses you cared for escaped and got injured on your watch you would be liable as the groom responsible.

If you’re an employed groom your employer will have their own insurance in place to cover incidents like this. This is a legal requirement - you should check that they have employer's and public liability insurance. You do not need to purchase your own liability insurance.

However, self-employed or freelance grooms probably will not be covered by the client and should therefore consider having their own grooms' liability insurance to cover for horse handling, clipping, exercising and riding.

|

The BGA Freelance Groom Liability Insurance is an affordable and suitable policy for any freelance groom, with the option to add in cover for coaching too. As well as Public Liability, the policy also automatically includes cover for Custodial Liability (Care, Custody & Control). This policy is designed specifically for grooms, by KBIS British Equestrian Insurance, so you can rest assured that you will be fully covered in your line of work. |

INSURANCE FOR WORKING WITH HORSES ABROAD

If you're planning on working abroad then you will need to take out specific travel insurance to cover you for medical expenses and repatriation.

The majority of holiday travel insurances will not cover you as you are working, this detail will be easily discovered by the provider in the case of a claim, so it is critical that you have adequate cover.

Our BGA Travel Insurance protects grooms working with horses while they are abroad, worldwide.

It is strongly advised to purchase travel insurance before you leave the UK.

What the personal accident policy covers you for:

- Whilst at work

- All stable duties – mucking out, grooming, washing off, turning out

- Clipping

- Riding – including hacking and jumping

- Hunting

- Lunging

- Breaking in

- Holding horse for a vet and other procedures

- Travelling horses both in the UK and abroad

- Competing in line with your job including: jumping, dressage, eventing

- Injuries that may happen to you whilst you are teaching - but you must also be grooming as part of your duties and not be a sole instructor

What the personal accident policy doesn’t cover you for:

- Riding in a race, point to point or team chase

- Stunt Riding

- Accidents occurring whilst travelling to and from work

- Riding and competing your own horse (but you can upgrade when applying for membership to include this)

- Public Liability – this is a separate insurance policy - the Freelance Groom Liability Insurance

- Care Custody and Control – this is a separate policy - the Freelance Groom Liability Insurance

If you require additional cover then please contact KBIS directly.

| GROOM | RIDER | EMPLOYER | |

|

When you are working for other people you do most of the following; muck out, turn out/catch in, tack up, groom horses, exercise Horses (including hacking, jumping and schooling), in the care of your employer/client. |

|

|

|

| Predominantly ride horses for other people including schooling, exercising and competing. | NO |

YES |

YES |

| Provide grooming services for someone else either full time or on a freelance basis i.e. an employer or a client. | YES |

NO |

NO |

| Employ staff – have an employers liability policy in your name | NO | NO | YES |

| Buy and sell horses | NO | YES | YES |