- Join Now

- Login

- Member Zone

- Your Career

- Freelancing

- International Grooms Association

- BGA Training

- Healthy Yard Healthy Horses

- Transporting horses

- Brexit

- Safe workplace

- Student Zone

- Member Discounts

- BG Magazine

- Member services

- My employment

- Am I employed correctly

- Grooms Minds

- Safeguarding

- Legal Helpline

- BGA guide to the National Minimum Wage

- Training & Careers

- BGA CV Creator

- Horse groom training

- Where to Train

- BGA E Learning

- Career choices

- Change to Racing

- First Aid training for grooms

- Parents

- Grooms Jobs

- Grooms Life

- About

- News

- Contact

SORRY, THIS SECTION IS RESTRICTED TO BGA Members only

If you are currently a BGA Member please login below.

However if you are not yet a BGA Member we would love to welcome you to join your professional association.

Membership benefits include…

-

Personal accident insurance

When things go wrong, you need insurance that goes right.

If you work with horses it is recommended that you have personal accident insurance cover in place.

Tell me more -

Support and advice

You are not alone. The BGA understands your world.

Becoming a member means you are only a click away from accessing support, advice and guidance on all groom, career and employment related matters.

Tell me more -

Freelancers Toolkit

Get advice and more for your freelance grooming business.

A range of toolkits specifically for freelancer grooms including advice on how to start and manage and grow your business.

Tell me more -

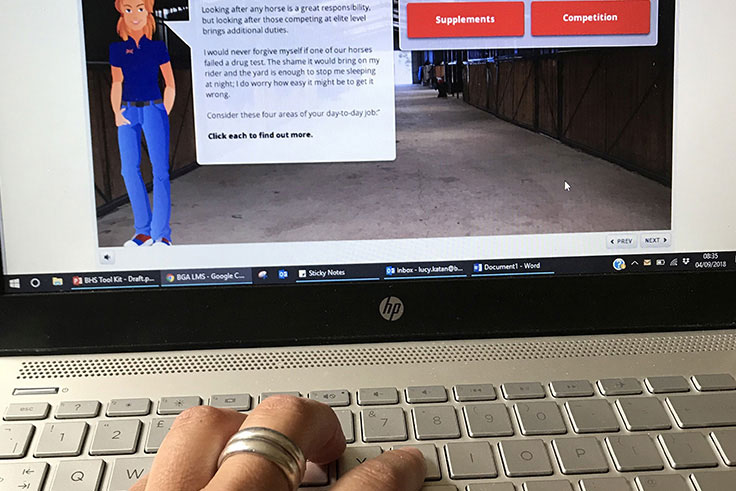

Online training for you

Bespoke training and certification for your career development.

Benefit from our dedicated online information training and development resources and add to your qualifications.

Tell me more

Lots more

Discover hereNot sure which BGA Membership to go for?

Why not try out our Membership Matcher